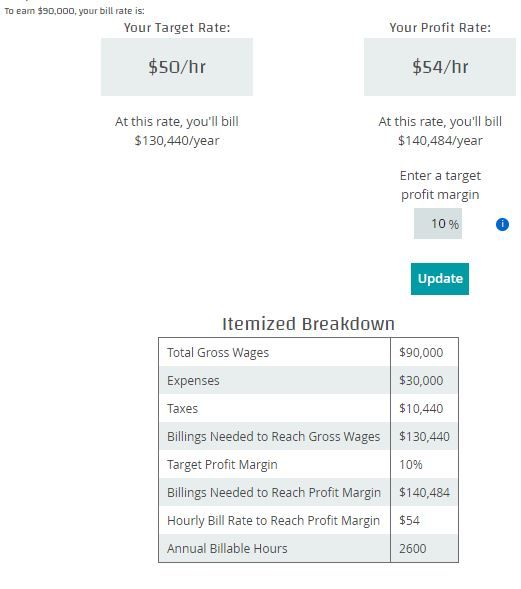

Annual after tax income calculator

If you make 55000 a year living in the region of California USA you will be taxed 11676. How to calculate annual income.

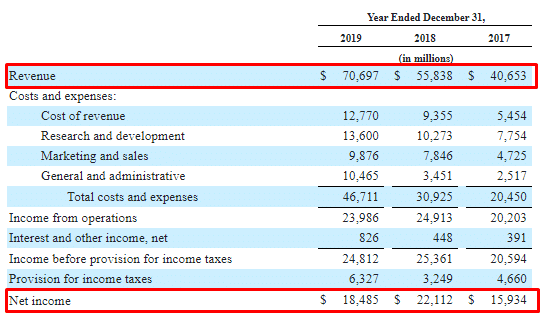

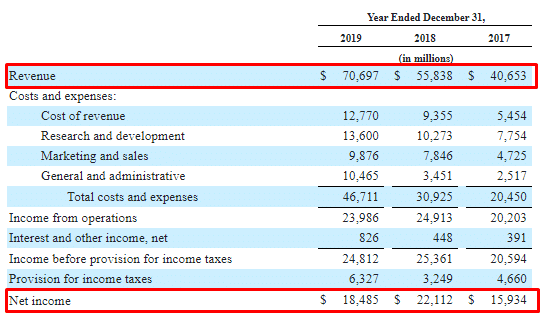

Profit After Tax Definition Formula How To Calculate Net Profit After Tax

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

. That means that your net pay will be 37957 per year or 3163 per month. Your employer withholds a 62 Social Security tax and a 145 Medicare tax from your earnings after each pay period. Simply enter your annual or monthly income into the tax calculator above to find out how US taxes affect your income.

Italy Annual Salary After Tax Calculator 2022. If you earn over 200000 youll also pay a 09 Medicare surtax. It is mainly intended for residents of the US.

Your average tax rate is. It can also be used to help fill steps 3 and 4 of a W-4 form. After-Tax Income Gross Income Taxes After-Tax Income 75000 2115750 5384250 Therefore the individuals after.

Annual Income 15hour x 40 hoursweek x 52 weeksyear Annual Income 31200 Your annual income would be 31200. Your average tax rate is. Let The Hourly Wage Calculator do all the sums for you - after the tax calculations see the annual pay and the monthly weekly or daily take-home.

If you make 55000 a year living in the region of Texas USA you will be taxed 9076. Your average tax rate is. The Annual Tax Calculator is our most comprehensive UK payroll tax calculator with features for calculating salary PAYE Income Tax Employee National Insurance Employers National.

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Income tax calculator How much Australian income tax should you be paying. And is based on the tax brackets of 2021 and.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Discover what a difference a few hours. Now we can calculate their after-tax income.

If you know your tax code you can. That means that your net pay will be 43041 per year or 3587 per month. How much Australian income tax you should be paying what your.

If you make 55000 a year living in the region of New York USA you will be taxed 11959. The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return. Youll then get a breakdown of your total tax liability and take-home.

For example if an employee earns 1500. That means that your net pay will be 43324 per year or 3610 per month. Using the annual income formula the calculation would be.

The Annual Wage Calculator is updated with the latest income tax rates in Italy for 2022 and is a great calculator for working. 1 minutes On this page Helps you work out. That means that your net pay will be 45925 per year or 3827 per month.

If you make 52000 a year living in the region of Ontario Canada you will be taxed 14043. Using The Tax Calculator To start using The Tax Calculator simply enter your annual salary in the Salary field in the left-hand table above.

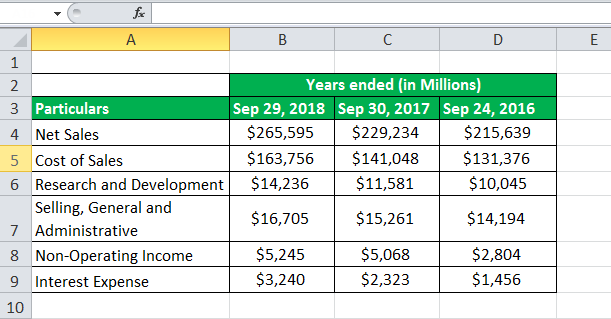

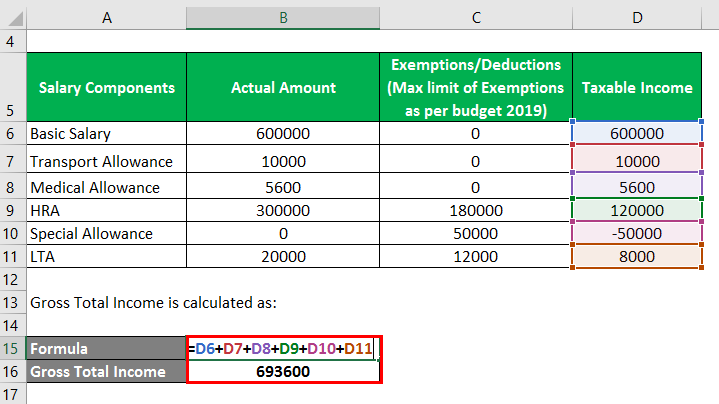

How To Calculate Income Tax In Excel

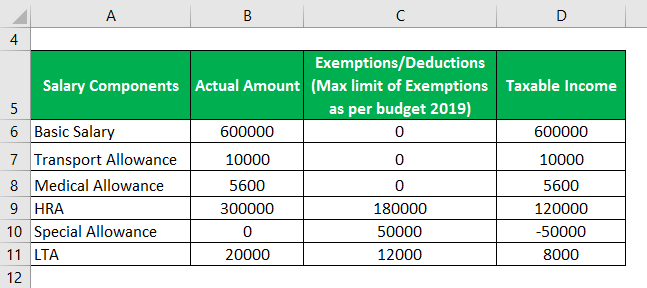

Taxable Income Formula Calculator Examples With Excel Template

Profit After Tax Definition Formula How To Calculate Net Profit After Tax

Taxable Income Formula Examples How To Calculate Taxable Income

Taxable Income Formula Examples How To Calculate Taxable Income

Annual Income Calculator

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

Net Income After Taxes Niat

What Is Net Income Definition Formula And How To Calculate Stock Analysis

Taxable Income Formula Examples How To Calculate Taxable Income

Net To Gross Calculator

Taxable Income Formula Calculator Examples With Excel Template

Gross Vs Net Income Key Differences How To Calculate Mbo Partners

Taxable Income Formula Calculator Examples With Excel Template

Taxable Income Formula Calculator Examples With Excel Template

Taxable Income Formula Examples How To Calculate Taxable Income

Taxable Income Formula Calculator Examples With Excel Template

Excel Formula Income Tax Bracket Calculation Exceljet